Introducing a new supplier to your business isn’t just about the service they deliver. It’s also about trust. However trust isn’t inherent. It needs to be built on a foundation of visibility, communication and proven action.

In this article, we take a look at how supplier management software from Gatekeeper can help you achieve to improve supplier relationships and third-party compliance.

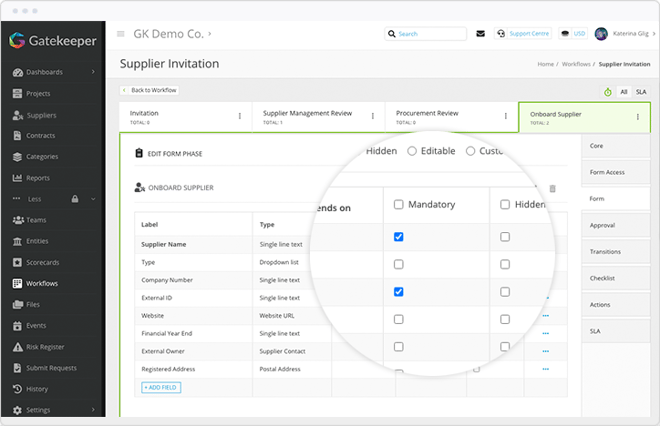

How much time do you spend chasing suppliers for information relating to compliance? With supplier management software, you can take back control and close informational gaps before they have a chance to appear. Make data gathering a mandatory step ahead of onboarding, putting the onus on your supplier to deliver complete and accurate information.

Gatekeeper allows you to delegate data input to suppliers with Public Forms. Choose what information you require from suppliers and then mandate its submission via your form.

Delegating responsibility in this way to suppliers gives you greater control of your relationships, enhances compliance within your business and helps you to control the level of supplier risk you’re introducing through new relationships.

Access to up-to-date information will help your business to check the viability of suppliers at all times.

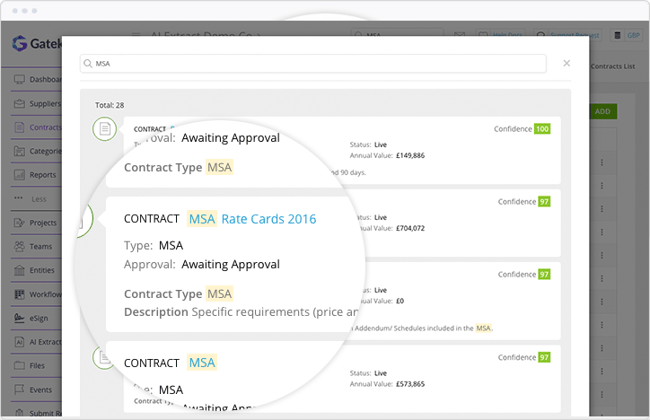

If you are unable to quickly find and access documents such as security certificates or reports, especially when your business is being audited, you can leave your business open to sanction.

Without total visibility, documents can expire without your knowledge or no longer be compliant with updated regulations and legislation - exposing your business to legal and financial consequences.

Gatekeeper provides a secure, centralised repository where you can store supplier information. This provides you with a single source of truth, so you can easily see your suppliers’ compliance status and be alerted when any required information is missing.

Combined with a powerful OCR Search and Analysis you can quickly search for and find compliance-related documentation such as ISO reports, SOC certificates and MSAs. With Gatekeeper, you can achieve audit-readiness.

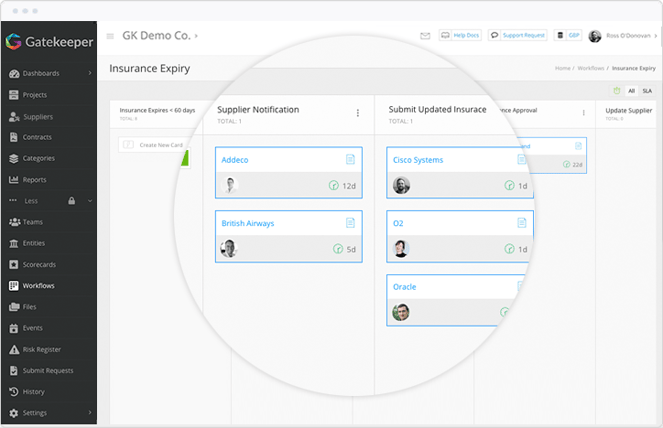

Regulation changes, new legislation is created and documents expire. That means proving supplier compliance doesn’t just end at centralising their information. Managing compliance effectively is an ongoing and active task, so you should build in time for internal reviews throughout the length of the relationship. This will allow for honest and timely communications with third parties.

Leverage the powerful Kanban Workflow Engine from Gatekeeper to automate the review process. Use key dates such as ‘Document Expiry’ to trigger alerts to stakeholders that a supplier compliance review is required.

When the internal review is marked as completed, notifications can be automatically sent to suppliers letting them know action - such as updating license or insurance documentation - is required. This automation saves valuable time, keeps your business in control and holds suppliers accountable for their compliance.

There are many ways software can improve supplier compliance, but keeping it simple to begin with is the best way to take back control. Gathering up-to-date information, storing it centrally and carrying out regular audits will give your business an accurate picture of the current level of its suppliers’ compliance.

If you’re ready to start implementing these steps, or want to know how else Gatekeeper can help you to improve supplier compliance, book a demo or get in touch.

Ready to improve your contract & vendor management?

.png)

.png)

.png)

-4.png)

Before Gatekeeper, our contracts

Anastasiia Sergeeva, Legal Operations Manager, BlaBlaCar

were everywhere and nowhere.

Gatekeeper is that friendly tap on the shoulder,

Donna Roccoforte, Paralegal, Hakkasan Group

to remind me what needs our attention.

Great System. Vetted over 25 other systems

Randall S. Wood, Associate Corporate Counsel, Cricut

and Gatekeeper rose to the top.

Thank you for requesting your demo.

Next Step - Book a Call

Please book a convenient time for a quick call to discuss your requirements.