In 2026, contract management is a board-level control system for compliance, cost, and risk. Every agreement encodes margin, regulatory exposure, operational obligation, and long‑term financial commitment.

Contracts are not neutral documents; they are instruments of control - or loss.

When contracts are managed in silos, value leaks quietly. Auto‑renewals roll forward without scrutiny. Non‑compliant vendors stay live because no one sees the gap. Spend drifts away from what was negotiated because Finance never sees the contract terms tied to actual invoices.

None of this looks dramatic day to day, but over time it erodes EBITDA, weakens audit posture, and forces teams into constant cleanup mode.

When contracts are governed centrally, the dynamic changes. They stop being static records and become active levers: protecting margin, enforcing policy, and creating audit readiness by design rather than by panic.

This shift is why Contract Lifecycle Management (CLM) has reached a breaking point.

Traditional CLM tools were built to digitize workflows - drafting, redlining, approval routing, and signature. They made Legal faster and procurement more orderly. But they were never designed to connect contracts to third‑party risk, live spend, or ongoing compliance obligations. As organizations scaled, that limitation became structural.

In 2026, speed alone is no longer enough. Control is the mandate.

Most CLM platforms fail in the same way: not because they lack features, but because they sit in isolation.

No one owns the full picture.

This is why contracts fail after signature. Not because a clause was missed, but because no system connects what was agreed to what is actually happening.

Obligations go untracked. Renewals slip past unnoticed. Spend creeps upward without contractual context. Audit evidence lives in inboxes until someone goes looking for it under pressure.

Even the most polished CLM interface cannot solve this. The problem is not usability. It is architecture.

CLM treats contracts as documents. Modern organizations need contracts to function as living control systems.

This shift is not theoretical. It is already underway.

This signals something important. Organizations are not adopting AI to experiment. They are adopting it to regain control in an environment where complexity has outpaced headcount.

Contract management sits directly in the middle of that pressure.

Mid-market, compliance-focused businesses require a fundamental change in operating model.

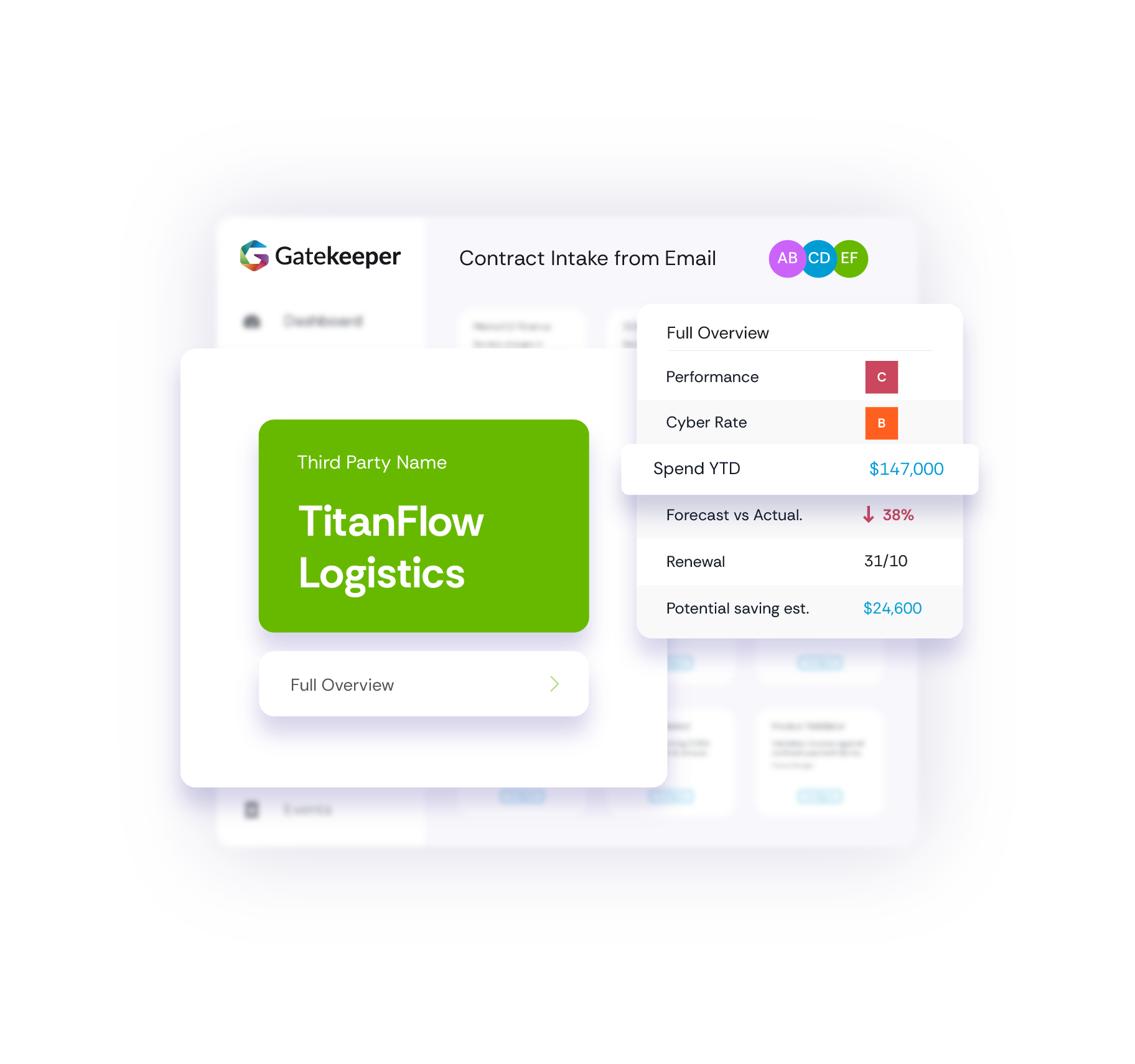

Instead of managing contracts, third‑party risk, compliance evidence, and spend as separate workflows owned by separate teams, a unified contract and third-party model treats them as one continuous lifecycle.

Every vendor, every agreement, and every obligation exists as a single, shared record - enriched continuously with risk, performance, and financial signals.

In this model, contracts are not reviewed once and forgotten. They are monitored by AI agents.

Risk is assessed before intake, not after signature. Policy and financial thresholds are enforced during drafting, not escalated late. Obligations, SLAs, and renewal dates are tracked automatically, not remembered manually. Finance sees commitments and exposure in real time, not months later during reconciliation.

The outcome is not just efficiency. It is institutional memory.

LuminIQ is Gatekeeper’s embedded AI layer, designed specifically for this unified model. It is not a chatbot and it is not an add‑on. It is a set of always‑on AI agents operating across the full contract lifecycle.

Where traditional tools wait for humans to notice problems, LuminIQ is designed to surface them early.

The result is not automation for its own sake. It is shared confidence across teams.

AI best practice in contract management is no longer about novelty or speed. In 2026, it is about preventing problems before they surface, not reacting after value has already leaked.

LuminIQ is designed around a simple principle: AI should reduce exposure and workload at the same time - without removing human control. That means applying intelligence across the entire contract lifecycle, not concentrating it in a single moment like drafting or review.

The biggest gains from LuminIQ happen before a contract reaches Legal.

By applying AI at intake, LuminIQ ensures that contracts which are out of policy, over budget, or tied to unacceptable risk are surfaced immediately. This prevents teams from wasting time negotiating agreements that should never move forward in the first place.

The benefit is immediate: Legal review queues shrink, Procurement stops pushing low-quality requests uphill, and Finance no longer discovers risk only after approval has already been granted. Instead of fixing bad contracts late, the organization quietly blocks them early.

During negotiation, the value of LuminIQ is not speed for its own sake. It is consistency and confidence.

LuminIQ guides negotiations inside pre-approved boundaries, highlighting risky deviations and suggesting compliant alternatives in real time. Contracts move forward without constant escalation, while Legal retains full authority over true exceptions.

The benefit is a fundamental shift in how Legal operates. Reviews focus on material risk, not repetitive clean-up. Negotiations move faster - not because corners are cut, but because risk is surfaced early and handled deliberately.

Most contract systems lose relevance once a contract is signed. This is where LuminIQ delivers its greatest value.

After execution, LuminIQ continues to monitor obligations, renewal terms, performance milestones, and commercial commitments, and connects them directly to live spend data.

The benefit is clarity. Finance no longer learns about margin erosion when invoices arrive. Procurement no longer misses renewal windows. Compliance no longer scrambles to reconstruct obligations during audits. Contracts remain visible, active, and enforceable long after signature.

One of the most overlooked benefits of LuminIQ is institutional memory.

Risk evidence, approvals, amendments, spend signals, and renewal activity are continuously tied back to the same contract record. Nothing depends on individual recollection or manual upkeep.

The benefit is resilience. Audit questions can be answered immediately. Knowledge doesn’t disappear when people change roles. Leadership gets certainty without reconciliation exercises. The system remembers what people shouldn’t have to.

The clearest signal that LuminIQ is working is not a dashboard - it’s what no longer occurs.

When applied correctly, LuminIQ doesn’t create more activity. It quietly removes friction, exposure, and noise - continuously.

For most organizations, AI in contract management isn’t about radical transformation or futuristic automation. It’s about removing the everyday friction that slows decisions, burns specialist time, and allows risk to surface too late.

CompSource Mutual Insurance illustrates how AI is being applied practically, incrementally, and with measurable impact.

CompSource Mutual operates in a highly competitive, price-sensitive market. Vendor volumes were growing, service expectations were rising, and margins were under constant pressure. At the same time, Procurement, Legal, and Finance operated in separate reporting lines.

Every contract required manual coordination across teams.

Reviews ping-ponged between Procurement and Finance

Issues surfaced late, triggering rework

Executives reviewed contracts line by line to keep approvals moving

Strategic initiatives like supplier consolidation stalled

The team wasn’t inefficient - the system was.

Rather than trying to automate the entire lifecycle at once, CompSource deployed AI at the highest-friction point: the Finance review stage.

This is where delays, rework, and escalation were most common - and where small improvements could unlock outsized value.

Using LuminIQ, CompSource automated the work that consistently slowed people down:

Contract values and budget allocations were extracted automatically

Contracts were validated against approved spend limits before Finance review

Over-budget contracts were stopped early, with exact overage calculations

Executives received concise AI summaries instead of full documents

The result was not faster contracting at any cost - it was cleaner handoffs and earlier control.

The impact was immediate and tangible:

95% reduction in executive review time: Leaders now review 10-line summaries instead of 13-page contracts, accelerating decisions without reducing oversight.

~636 hours saved annually: Equivalent to 17 weeks of capacity redirected from manual coordination to strategic procurement work.

Finance–Procurement handoffs largely eliminated: Budget issues and missing data are resolved before review, not after.

Audit readiness improved by default: Evidence and approvals are captured as part of the workflow, not reconstructed under pressure.

This is what AI adoption in contract management looks like in 2026:

AI is applied where work breaks down most often, not everywhere at once

Tactical checks are automated so people can focus on judgment

Value shows up in weeks, not months

Control improves without adding headcount

AI didn’t replace expertise at CompSource. It removed the friction that prevented expertise from being applied where it mattered most.

That’s why CompSource is now expanding LuminIQ usage across intake, risk tracking, and cross-functional workflows - confident that scale won’t come at the cost of control.

By 2026, the question is no longer whether organisations should modernise contract management. The question is what role contracts are expected to play in the business.

If contracts remain isolated documents - negotiated in one system, monitored in none, and reconciled after the fact - then even the most advanced contract lifecycle management will continue to fall short. Risk will surface late. Spend will drift. Compliance will rely on memory, spreadsheets, and last-minute effort.

But when contracts are treated as part of a unified control model - connected to third-party risk, live spend, and ongoing obligations — they become something else entirely. They become a system of record for commercial intent. A source of institutional memory. A mechanism for enforcing discipline at scale.

AI is what makes that shift possible.

Not AI as a novelty, or a drafting shortcut, but AI applied deliberately across the lifecycle: before contracts reach Legal, during negotiation, long after signature, and continuously in the background. When applied this way, AI doesn’t replace human judgment. It protects it — by removing the friction, noise, and blind spots that prevent teams from acting early and confidently.

The organisations pulling ahead are not the ones automating faster. They are the ones governing better.

That is why CLM alone is no longer enough.

In 2026, contract management is no longer an administrative function. It is a board-level control system - and AI, applied through a unified model, is what finally allows it to operate that way.

If you're ready to unify your approach, book a demo today.

Traditional CLM focuses on managing documents and workflows, not enforcing control after contracts are signed. In 2026, businesses need contracts connected to third-party risk, live spend, and compliance obligations. Without that unification, renewals are missed, spend drifts, and risk surfaces too late. CLM alone cannot provide the continuous oversight modern organizations require.

AI improves contract management by operating across the entire contract lifecycle, not just drafting. It screens risk at intake, enforces policy during negotiation, monitors obligations and renewals after signature, and connects contracts to real-time spend. This helps prevent margin erosion, reduce audit risk, and eliminate manual coordination between teams.

Unified contract management means contracts, third-party risk, compliance evidence, and spend are managed together in one continuous system. Every agreement exists as a single, living record enriched by AI with risk, performance, and financial data. This replaces siloed tools and enables continuous control instead of reactive cleanup.

Best practices include applying AI before Legal review, enforcing policy guardrails during negotiation, monitoring contracts after signature, and maintaining a single, living contract record. Leading organizations use AI to prevent issues early rather than just automate documents, while keeping human judgment and accountability in place.

Organizations apply AI at high-friction points such as intake, finance review, renewals, and audit preparation. AI is used to validate budgets, flag risk, summarize contracts for executives, and track obligations continuously. This shortens approval cycles, reduces rework, and frees teams to focus on strategic work rather than coordination.

Unify your contracts, third parties and spend data

.png)

.png)

.png)

-4.png)

Before Gatekeeper, our contracts

Anastasiia Sergeeva, Legal Operations Manager, BlaBlaCar

were everywhere and nowhere.

Gatekeeper is that friendly tap on the shoulder,

Donna Roccoforte, Paralegal, Hakkasan Group

to remind me what needs our attention.

Great System. Vetted over 25 other systems

Randall S. Wood, Associate Corporate Counsel, Cricut

and Gatekeeper rose to the top.

Thank you for requesting your demo.

Next Step - Book a Call

Please book a convenient time for a quick call to discuss your requirements.