-min.png)

An organisation’s contracts commonly remain scattered, unread and underutilised. Many contain significant, but often overlooked, financial risks which can have a direct impact on the organisation's financial health and strategic decision-making.

For CFOs, this increasingly makes vendor and contract visibility imperative for risk reduction.

This article outlines why CFOs should champion visibility to unlock financial accuracy, strategic control and risk resilience and how a Vendor and Contract Lifecycle Management (VCLM) platform can help.

Regulators, auditors and rating agencies increasingly probe penalty clauses, evergreen renewals, change-of-control fees, data-breach indemnities.

These contractual obligations sit off the balance sheet until a trigger event occurs, at which point they can destabilise cash-flow forecasts, breach covenant ratios or torpedo deal valuations.

Because the finance function signs off guidance to markets and boards, any blind spot in the contract portfolio ultimately converts into earnings-volatility risk for the CFO to explain.

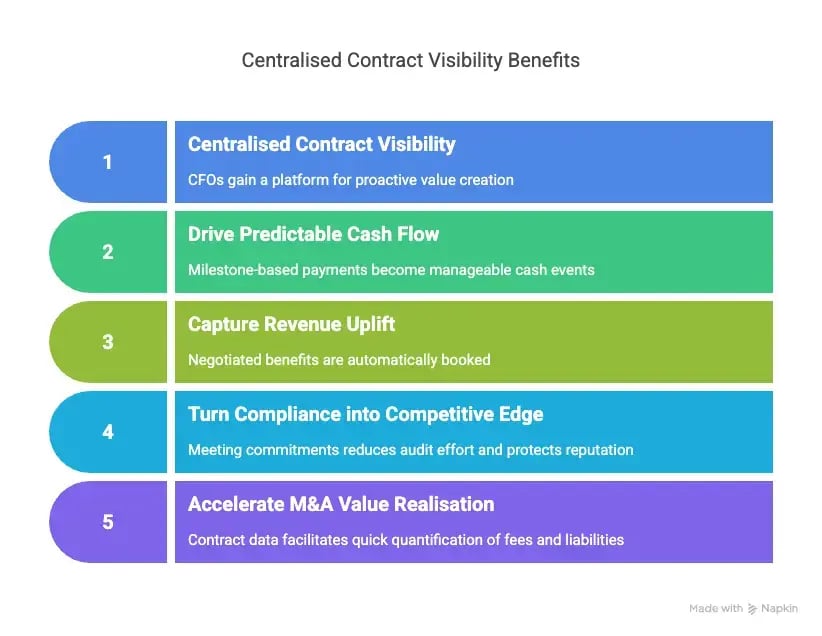

Centralised contract visibility gives CFOs a platform for proactive value creation. When every clause and commitment is searchable and connected to real-time dashboards, businesses can:

By reframing visibility as a springboard for growth, efficiency and strategic agility, CFOs can lead the charge to transform contracts into instruments of financial advantage.

The CFO's role in contract governance needs to extend beyond mere oversight, to include active leveraging of contract data to create financial value and strategic advantage. Areas involved include:

By embracing this expanded role, CFOs can transform contract management from a reactive necessity into a proactive driver of financial performance and strategic advantage. This ensures the finance function is at the heart of value creation, not just risk mitigation.

Achieving contract visibility requires much more than a technology upgrade; it necessitates a cultural shift within the organisation. CFOs are uniquely positioned to lead this transformation by:

Creating a visibility-first culture requires consistent effort and commitment from leadership, but the long-term benefits in terms of reduced risk, improved efficiency and enhanced strategic decision-making are substantial.

The CFO is critical for championing this cultural shift and embedding contract visibility into the organisation's standardised approach to the financial risks inherent in its contracts.

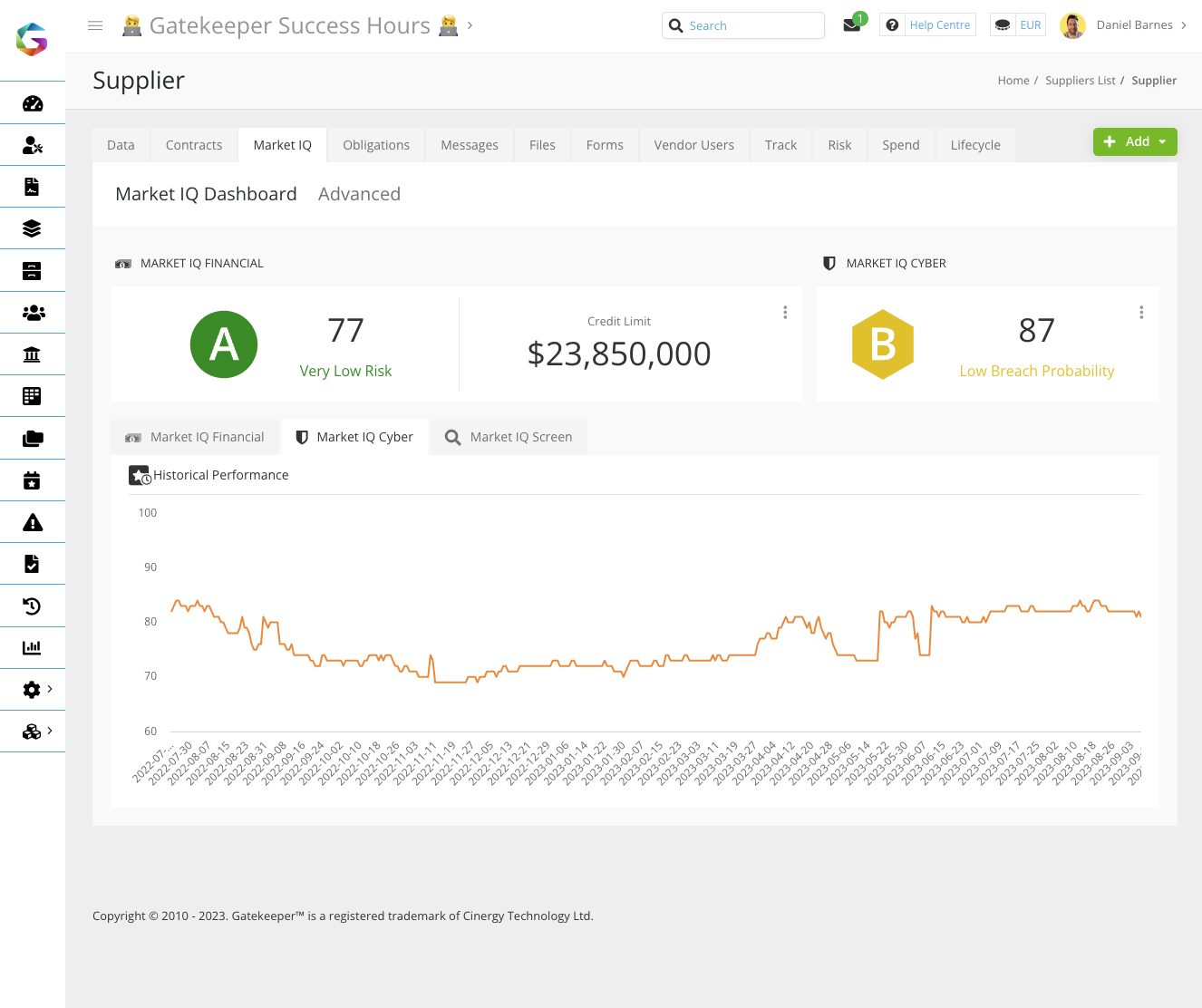

Gatekeeper transforms contracts from static documents into dynamic tools for financial control, risk mitigation, and strategic planning.

Providing CFOs with comprehensive, real-time insights to make informed decisions on vendor consolidation, cost-cutting or renegotiation opportunities, transforms them into proactive financial leaders.Gatekeeper’s Spend Module allow CFOs to monitor contract value, upcoming obligations, current risk status and compliance metrics in real-time. A wide range of configurable standard reports are available to display various aspects of recorded information.

Enhanced Financial Forecasting and Budget Accuracy

Enhanced Financial Forecasting and Budget Accuracy

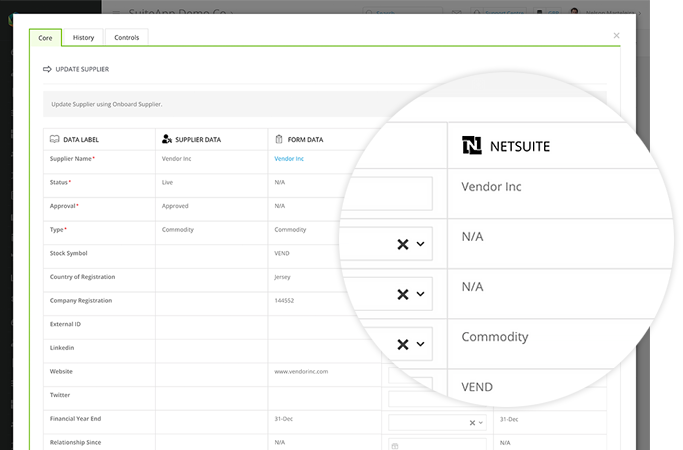

The availability of real-time, actionable intelligence needed for precise budgeting and cash flow forecasting eliminates financial surprises and enables more reliable financial planning and allocation of budgets.With Gatekeeper, CFOs and other authorised users can access all contracts in a single centralised platform, with key data fields extracted and standardised for easy analysis. Integration with ERP, procurement and financial planning tools such as Netsuite syncs contract data with budgeting, forecasting and audit systems.

Fortified Compliance and Reduced Financial Risk

Ensuring that no opportunity to renegotiate favourable terms or eliminate unnecessary spend is overlooked has a direct impact on the bottom line.

Proactive vendor and contract management is essential for driving stronger ROI from every vendor relationship, especially in an environment where cost control and margin protection are top priorities for CFOs.

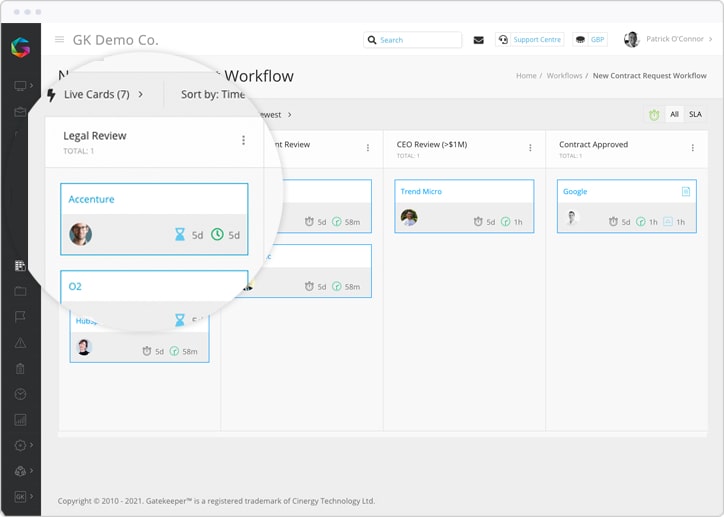

Gatekeeper’s best practice automated workflows are triggered well ahead of renewal deadlines, notice periods, or key contract milestones. This gives CFOs and their teams ample time to assess vendor performance, align stakeholders, and make informed decisions.

With Gatekeeper, finance leaders gain a clear, real-time view of contractual commitments and savings potential across the vendor portfolio.

For CFOs seeking to optimise spend and improve financial resilience, vendor consolidation represents a powerful lever.

Gatekeeper enables finance leaders to rationalise their supplier base by identifying redundancies, standardising terms, and consolidating contracts, unlocking immediate cost savings and reducing exposure to third-party risk.

By consolidating vendors, CFOs gain tighter control over indirect spend, simplify compliance, and free up resources for higher-value strategic initiatives.

Conclusion

By taking ownership of contract governance and strategically investing in VCLM software like Gatekeeper, finance leaders can eliminate costly hidden risks, mitigate exposure, and empower smarter, faster decision-making across the entire contract lifecycle.

This proactive approach positions CFOs and their organisations to cope with volatility, uncertainty, complexity and ambiguity with confidence, and unlock the full value of their vendor and contract relationships.

CFOs who take ownership of this agenda won’t just reduce risk, they’ll increase the organisation’s financial resilience and its readiness for what comes next.

Ready to transform your vendor and contract management and empower your finance team? Book your demo today.

Ready to improve your contract & vendor management?

.png)

.png)

.png)

-4.png)

Before Gatekeeper, our contracts

Anastasiia Sergeeva, Legal Operations Manager, BlaBlaCar

were everywhere and nowhere.

Gatekeeper is that friendly tap on the shoulder,

Donna Roccoforte, Paralegal, Hakkasan Group

to remind me what needs our attention.

Great System. Vetted over 25 other systems

Randall S. Wood, Associate Corporate Counsel, Cricut

and Gatekeeper rose to the top.

Thank you for requesting your demo.

Next Step - Book a Call

Please book a convenient time for a quick call to discuss your requirements.