.jpg)

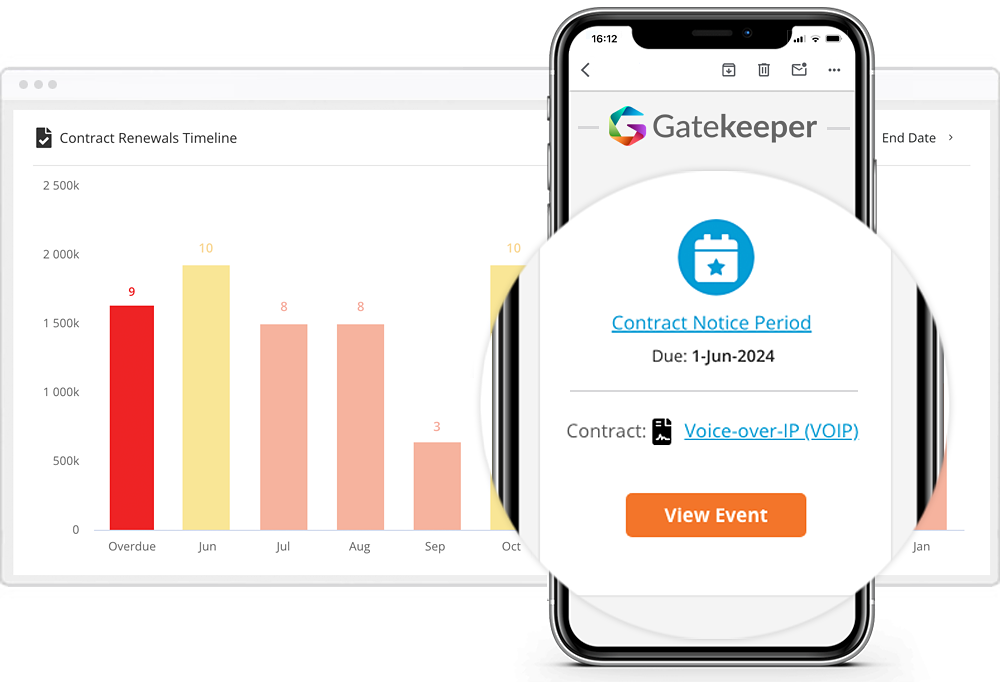

When contract terms live in Legal, risk in Procurement, and spend in Finance, financial institutions lose visibility across critical third-party relationships. That’s when risk grows, renewals stall, and unchecked spend erodes margins.

Gatekeeper unifies third-party risk, contract management, and vendor spend in a single platform purpose-built for financial services, with LuminIQ AI Agents surfacing risks and enforcing controls automatically.

Eliminate silos between teams. Enforce policy across every contract, vendor, and process. Prove compliance from onboarding through to audit.

One unchecked third-party agreement can lead to regulatory fines, failed audits, or reputational damage. With mandates like AML, KYC, SOX, FCA, and DORA, there’s no room for gaps.

Gatekeeper enforces vendor due diligence and automated compliance checks before any contract is signed. AI Agents screen, score, and approve or flags vendors, so bad actors never get through.

Every contract. Every check. Captured in one continuous, auditable record, ready in seconds. No last-minute evidence gathering. Just perpetual audit readiness built into every vendor decision.

-Mar-27-2025-01-21-11-8144-PM.png)

-3.png)

Third-party failures drive up costs through fines, revenue loss, and remediation efforts.

Gatekeeper’s AI agents surface risk signals from day zero, keeping you compliant with DORA, SOX, and FCA, and protecting margin before it’s under threat.

AI Agents continuously monitor third-party risk such as, cyber threats and financial changes, so you can act before risk leads to revenue loss for your financial institution.

Delays at any stage, from onboarding to redlining, slow revenue and add risk, whether you're signing a CRO, launching new products, or finalising M&A.

Gatekeeper streamlines the full contracting process. AI Agents automate contract intake, provide clause suggestions and complete approval routing.

Our unified contract and third-party risk management platform accelerates approvals and ensures compliance from intake to close-out.

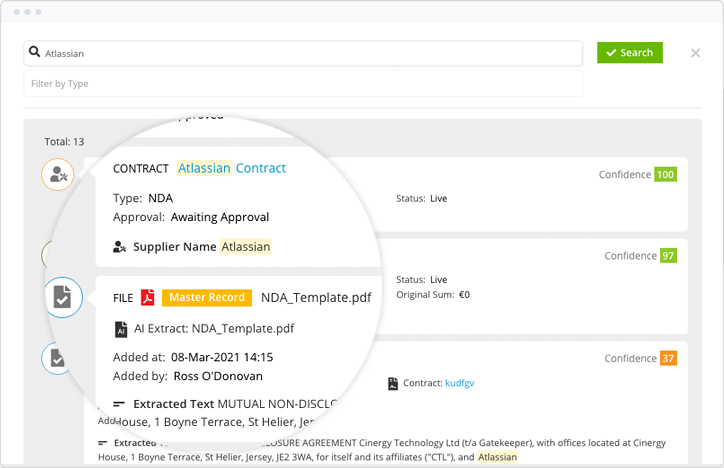

Silent auto-renewals. Overlooked obligations. Fragmented agreements that miss out on bundled value. That’s how margin erodes, one contract at a time.

With best practice workflows, you gain full visibility across contract renewals, contract obligations, and vendor performance, so you can renegotiate before value slips and eliminate waste before it renews.

Catch costly renewals. Consolidate smarter. Protect profit, contract by contract.

.png)

.png)

.png)

-4.png)

Before Gatekeeper, our contracts

Anastasiia Sergeeva, Legal Operations Manager, BlaBlaCar

were everywhere and nowhere.

Gatekeeper is that friendly tap on the shoulder,

Donna Roccoforte, Paralegal, Hakkasan Group

to remind me what needs our attention.

Great System. Vetted over 25 other systems

Randall S. Wood, Associate Corporate Counsel, Cricut

and Gatekeeper rose to the top.

Thank you for requesting your demo.

Next Step - Book a Call

Please book a convenient time for a quick call to discuss your requirements.