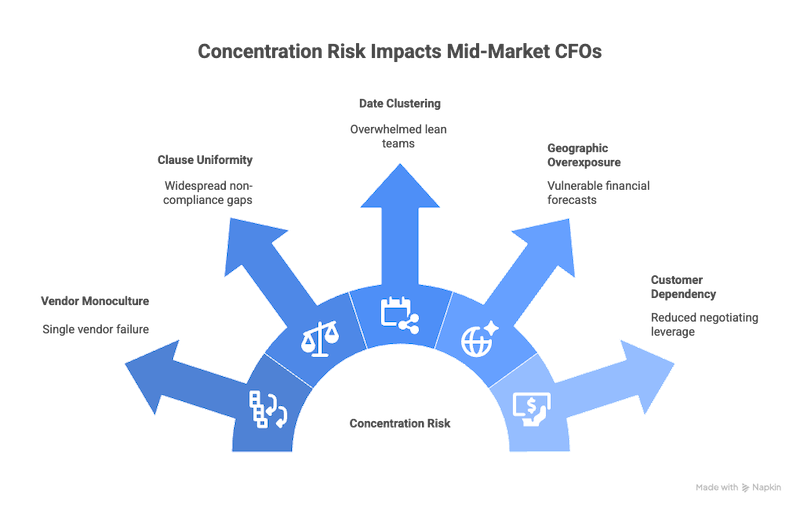

Concentration risk is the financial and operational exposure created when critical dependencies are concentrated in too few vendors, geographies, currencies, customers, or contract clauses.

For mid-market organisations, it’s often hidden - until it triggers margin erosion, missed renewals, stalled audits, or supply chain failures. What once looked like operational efficiency can quickly become structural fragility.

And for CFOs, it’s a strategic risk that directly impacts EBITDA, forecast accuracy, and resilience under scrutiny.

In this article, we’ll break down the most common sources of contract and third-party concentration risk, explain why traditional tools fail to address them, and outline how unifying contract, risk and spend data in a single system gives CFOs the visibility - and control - needed to prevent small issues from turning into major financial events.

The concept of concentration risk isn’t new, but its modern form is harder to detect, faster to escalate, and more likely to impact the bottom line. Today, exposures are dispersed across contracts, third-parties and siloed systems, often unnoticed until they trigger a renewal crisis, regulatory breach or vendor failure.

Mid-market CFOs face the sharpest edge of this problem. They’re held to enterprise-level standards with lean teams and, often, fragmented tools from spreadsheets through to contract management software. That makes them uniquely vulnerable to five systemic patterns of concentration:

All five patterns share one core issue: they stay hidden because the data that reveals them is spread across different systems and teams. No single dashboard shows the whole dependency picture.

That’s why organisations only see concentration risk when it has already turned into a failure event. Detecting and reducing it requires a cross-functional view of all contracts, vendors and obligations in one unified system.

These pressures aren't hypothetical. In 2024, the CrowdStrike outage illustrated just how exposed mid-market organisations can be when vendor reliance is unchecked.

The outage triggered global system crashes - grounding airlines, halting banks, and freezing logistics. For many mid-market firms, CrowdStrike was the default endpoint provider, embedded through MSPs with no fallback plan.

Recovery was slow not just because of the outage, but because too much risk was concentrated in a single vendor. In some cases, multiple suppliers were also dependent on CrowdStrike - exposing a fourth-party blind spot.

The lesson? Vendor monoculture may simplify procurement, but it magnifies operational fragility. Firms with diversified or documented dependencies recovered faster. Those without paid the price.

The irony is that many organisations believe they are addressing these risks because they’ve purchased contract lifecycle management (CLM) software, third-party risk management (TPRM) software, or spend visibility solutions (S2P). But these tools, while useful in their silos, reinforce the very fragmentation that allows risk to persist:

The result? Fragmented ownership, inconsistent data, and leadership teams that only discover issues after they’ve become incidents.

This leaves most organisations treating the visible effects of concentration risk on a case-by-case basis, without addressing the systemic dependencies that caused them.

The outcome? The underlying risk remains unaddressed until it escalates into failure, often in the form of preventable, high-impact events like these:

Gatekeeper eliminates these concentration exposures by unifying all contract and third-party data - risk, obligations, compliance and spend - into a single platform. One record per third party. One logic layer. One system of insight. This is how you turn a compliance overhead into a strategic asset.

Gatekeeper, powered by LuminIQ AI agents, is built to expose and eliminate concentration risk - before it shows up in missed renewals, margin erosion or failed audits.

By unifying all contract, vendor, risk and spend data into a single platform, Gatekeeper transforms scattered signals into a continuous system of control.

Each insight reduces exposure. That’s how Gatekeeper turns concentration risk from an invisible threat into a controllable variable - powered by unified data, not disconnected tools.

Fragmented systems don’t just slow teams down - they expose the business to compounded risk. It’s expensive, and a structural failure that only the CFO has the authority and the visibility to correct.

Gatekeeper gives CFOs the ability to:

This isn’t about adding another tool. It’s about owning the structural defence against the hidden dependencies spread across your contract and third- party portfolio.

Concentration risk is structural. Gatekeeper is the structural solution for it - built for one thing: to close the gaps where risk lives. It replaces siloed tools with one unified platform. It replaces quarterly panic with continuous oversight. It replaces manual effort with best practice.

Book a demo today to see how Gatekeeper transforms hidden risk exposure into measurable control - and why the CFO is best placed to lead the charge.

Concentration risk is the financial and operational exposure created when too much reliance is placed on a small number of vendors, geographies, currencies, customers, or contract terms. For mid-market CFOs, it is not just an operational oversight - it is a structural vulnerability that erodes EBITDA, compromises forecast accuracy, and fails under regulatory scrutiny. It often remains hidden in siloed tools until it results in margin loss, failed audits, or vendor collapses.

Traditional point tools operate in silos. CLMs handle documents, TPRMs collect static questionnaires, and S2Ps track transactions without linking them to contractual or risk obligations. This fragmented approach creates blind spots where critical dependencies accumulate unseen. Gatekeeper solves this by unifying contracts, vendors, risks, and spend into a single system with real-time visibility and control.

Gatekeeper neutralises concentration risk by consolidating all contract, vendor, and spend data into one unified platform. Its LuminIQ AI agents screen vendors before engagement, apply risk-aligned contract terms, and continuously monitor for overexposures, renewal spikes, and customer dependencies. Every insight helps reduce structural fragility before it escalates into failure.

Events like the CrowdStrike outage revealed how mid-market firms were paralysed by their reliance on a single vendor - with no fallback plan or visibility into fourth-party dependencies. Gatekeeper helps prevent these failures by surfacing patterns such as vendor monoculture, SLA drift, and renewal clustering before they create financial or operational disruption.

Gatekeeper is purpose-built to unify risk-first onboarding, AI-guided contracting, and proactive spend management. Unlike traditional suites that only serve siloed needs, Gatekeeper delivers company-wide control from day one. It helps lean teams achieve enterprise-level resilience, audit readiness, and margin protection - without the delays or complexity of legacy systems.

Ready to improve your contract & vendor management?

.png)

.png)

.png)

-4.png)

Before Gatekeeper, our contracts

Anastasiia Sergeeva, Legal Operations Manager, BlaBlaCar

were everywhere and nowhere.

Gatekeeper is that friendly tap on the shoulder,

Donna Roccoforte, Paralegal, Hakkasan Group

to remind me what needs our attention.

Great System. Vetted over 25 other systems

Randall S. Wood, Associate Corporate Counsel, Cricut

and Gatekeeper rose to the top.

Thank you for requesting your demo.

Next Step - Book a Call

Please book a convenient time for a quick call to discuss your requirements.