Limited visibility and ineffective controls often undermine vendor management. This combination easily leads to increased risks, potential non-compliance, and penalties that can disrupt your business.

A Gartner survey reveals that:

In 2025, your business needs to overcome the ongoing rise of cyber threats targeting third-party vendors, ensure compliance throughout its entire supply chain and leverage technology to streamline processes and strengthen vendor relationships.

In this article, we'll explore how to manage your vendors by exploring:

Vendor management is a systematic approach to developing and monitoring third-party providers of goods and services. Done well, it allows businesses to maximise contract value, optimise renewals, and build mutually beneficial, long-term relationships.

Your business’s vendor relationship management (VRM) approach can be evaluated in terms of maturity.

The diagram below shows the path to maturity in vendor relationship management. Take a moment to identify where you think your business sits on this path. Wherever you identify your organisation along this continuum, there are likely to be improvements you can make.

An immature vendor management approach is characterised by:

On the other hand, mature organisations exhibit

Use our maturity assessment below to assess your current level of maturity and identify where you can improve.

Managing vendors effectively requires a strategic approach to ensure smooth operations, mitigate risks, and maximise value.

By focusing on these six key areas, supported by vendor management software, you can build stronger vendor relationships and streamline processes.

Establishing clear Key Performance Indicators (KPIs) at the outset is critical for successful vendor management. KPIs provide measurable benchmarks that align vendor performance with organisational objectives, ensuring accountability and fostering collaboration.When defining KPIs, it’s essential to customise them based on the vendor’s role. These KPIs can form part of a Vendor Scorecard covering areas key to the value delivered by your third parties. The Key Performance Indicators you should focus on include:

By implementing vendor performance scorecards and dashboards to track KPIs, organisations can gain real-time insights into vendor performance, enabling proactive interventions if standards aren’t met. Setting expectations early streamlines communication and promotes alignment, ultimately driving better results.

![]() Vendor performance scorecards in Gatekeeper

Vendor performance scorecards in Gatekeeper

Vendor onboarding is a critical step in building a productive relationship, yet it is often fraught with inefficiencies if done manually. Streamlining this process with a VCLM platform reduces delays and sets the tone for a positive vendor experience.A key component of this is leveraging a Vendor Portal. This dedicated area empowers vendors to take control of their onboarding journey by allowing them to upload documents, update their details, and track progress in real-time. This self-serve approach eliminates back-and-forth communications and ensures data accuracy, as vendors input their information directly.Automating workflows within the onboarding process can further reduce bottlenecks. From document verification to approval stages, automation ensures that tasks are completed promptly. By prioritising self-serve options, your organisation can free up time for procurement and legal teams to focus on strategic activities and improve vendor satisfaction simultaneously.

.jpg?width=724&height=468&name=Supplier_Onboarding-2%20(1).jpg)

Vendor performance scorecards in Gatekeeper

Managing due diligence during vendor onboarding and beyond is often a manual, time-consuming process prone to inconsistencies that can lead to non-compliance.

Implementing a VCLM platform that automates this process prevents you from chasing down information or manually assessing responses. By streamlining vendor due diligence and addressing compliance gaps early, you can avoid potential disruptions and ensure your vendor records remain accurate.

Automating data collection, validation, and scoring via Smart Forms allows you to standardise how vendor data is captured and evaluated. Scoring frameworks provide a consistent way to measure compliance, highlighting gaps or low scores that require immediate attention - especially during vendor onboarding.

.webp?width=1200&height=800&name=SmartForms_HeroImage%20(2).webp)

Effective vendor management depends on proper categorisation. Without it, your organisation risks treating all vendors the same, leading to inefficiencies and misaligned resource allocation.

Vendor categorisation should be based on factors such as risk, spend, and strategic importance. For instance, high-risk vendors handling sensitive data may require more frequent audits, while low-spend transactional vendors might follow a simplified workflow.

Many companies allocate their vendors into three groups by type:

Thoughtful categorisation simplifies collaboration and optimises resource allocation. However, if your business is at the low end of vendor management maturity, it may take some time to gather all the information you need. Using a VCLM platform that offers a repository to centralise all your risk and spend data will be beneficial here.

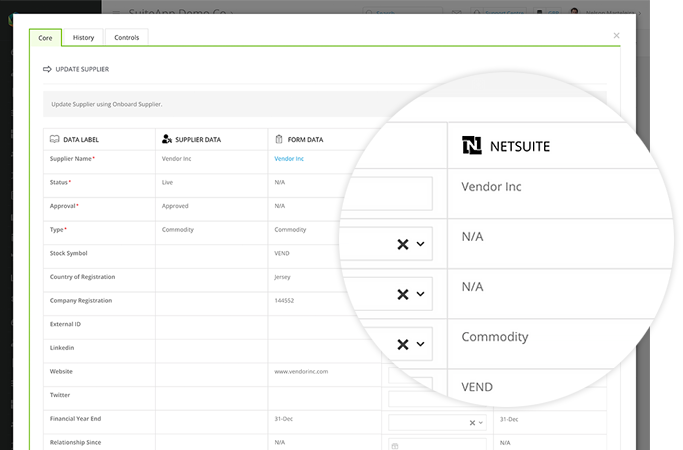

Without integration between your vendor management processes and enterprise resource planning (ERP) tools, fragmented insights, delayed reporting, and missed opportunities to control costs become inevitable.If you're currently relying on scattered Excel spreadsheets or outdated systems, using a VCLM platform can transform your processes with spend management dashboards and automated workflows. Gatekeeper's integration with NetSuite ensures a seamless connection between vendor and financial data, enabling your business to centralize and analyse spend effortlessly. By improving spend visibility, you can mitigate the risk of overpayments or duplicate invoices, support strategic decision-making, and uncover opportunities to optimise vendor relationships and renew terms more effectively.

Before using Gatekeeper, they faced challenges in tracking vendor due diligence and compliance, poor visibility and control of contract commitments, and issues with missed renewal deadlines.

Gatekeeper provided a centralised vendor and contract records repository, which enhanced organisation and governance. It also offered automated workflows for supplier due diligence, improving vendor tracking and response rates.

As a result of these improvements, Funding Circle achieved better control and visibility of spend, leading to cost savings of around £1 million by terminating contracts that were no longer required.

If you want to know more about how to manage your vendors, book a Gatekeeper demo today.

Ready to improve your contract & vendor management?

.png)

.png)

.png)

-4.png)

Before Gatekeeper, our contracts

Anastasiia Sergeeva, Legal Operations Manager, BlaBlaCar

were everywhere and nowhere.

Gatekeeper is that friendly tap on the shoulder,

Donna Roccoforte, Paralegal, Hakkasan Group

to remind me what needs our attention.

Great System. Vetted over 25 other systems

Randall S. Wood, Associate Corporate Counsel, Cricut

and Gatekeeper rose to the top.

Thank you for requesting your demo.

Next Step - Book a Call

Please book a convenient time for a quick call to discuss your requirements.