Ensuring third-party relationships are transparent and risk-free is a significant challenge in a world defined by globalisation, interconnectedness, and digitisation.

While these trends offer substantial benefits - such as opportunities for growth, supplier diversification, cost savings, and innovation - they also introduce increased complexity for Legal and Procurement teams responsible for third-party risk management.

Navigating these challenges requires visibility of third parties, robust risk management strategies, and a thorough understanding of potential vulnerabilities within the supply chain.

This is where Third-Party Risk Management (TPRM) dashboards come into play, offering a solution that enhances visibility and control over third-party interactions.

Operating without adequate visibility into third-party activities and risks exposes your organisation to several risks. These include:

Having visibility into these potential risks allows legal and procurement teams to take proactive measures. They can develop contingency plans, diversify their supplier base, and implement robust compliance checks to mitigate these risks. Visibility, combined with proactivity, helps legal and procurement teams to protect the business.

At Gatekeeper, we speak to Legal and Procurement professionals who manually monitor their third-party risk. They use spreadsheets, calendar reminders and email communication with vendors.

It’s no surprise that 59% of organisations say they are frustrated by the lack of visibility technology currently provides around third-party risk.

Third-party risk management dashboards, particularly when integrated within Vendor Contract Lifecycle Management (VCLM) software, increase visibility and significantly enhance the efficiency and effectiveness of legal and procurement teams.

Centralised Data Management

Third-party risk management dashboards within VCLM software consolidate all relevant data into a single, centralised platform. This integration allows legal and procurement teams to easily view and track vendor information, risk assessments, compliance statuses, and contract details, reducing the need for disparate systems and manual data entry.

Dashboards provide real-time visibility into vendor performance and risk metrics. Automated data feeds ensure the latest information is always available, enabling teams to make informed decisions quickly and accurately.

Enhanced Risk Visibility and Analysis

Dashboards offer a holistic view of third-party risks across the entire vendor portfolio. Visualisations such as charts, graphs, and heat maps make it easy to identify high-risk vendors, track risk trends, and pinpoint areas requiring immediate attention.

Third-party risk management dashboards help legal and procurement teams to prioritise vendor risk mitigation efforts. By clearly highlighting which vendors pose the highest risks, teams can focus their resources on the most critical issues first.

Safeguarded Compliance

Dashboards can be configured to send automated alerts and notifications when specific risk thresholds are exceeded or a vendor’s financial or cyber security posture changes. This proactive approach helps teams respond promptly to emerging risks and ensures timely compliance with regulatory requirements.

Generating reports becomes significantly more efficient with dashboards and a complete, auditable history of all remedial action taken. With just a few clicks, legal and procurement teams can create comprehensive risk reports for internal stakeholders, auditors, and regulatory bodies, saving time and improving audit preparedness.

MarketIQ's suite of TPRM dashboards is designed to mitigate third-party risks by providing comprehensive visibility into vendor activities.

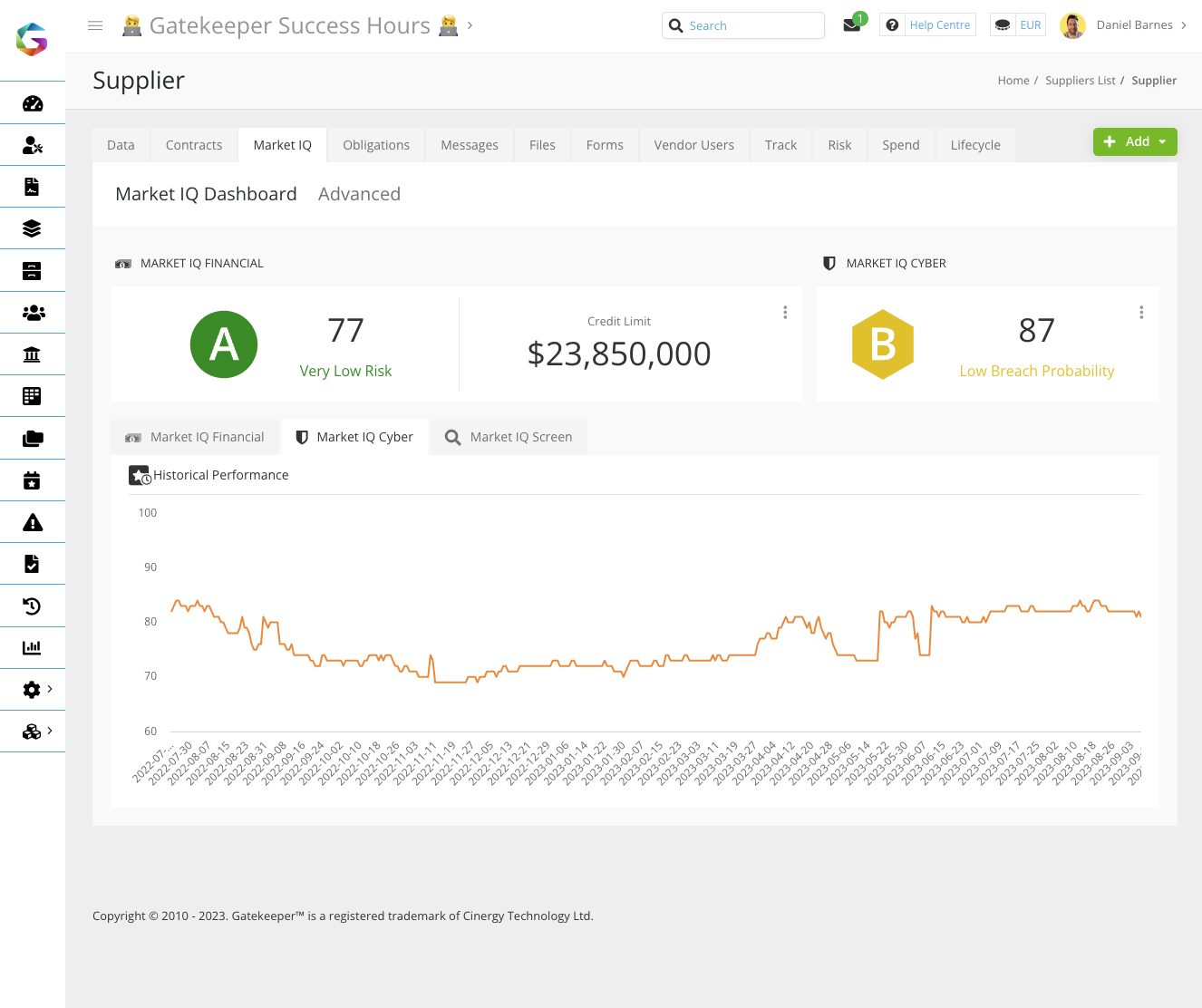

This dashboard-driven module, integrated within Gatekeeper, encompasses three key modules: Cyber, Screen, and Finance, each offering critical insights to ensure robust third-party risk management.

Together, these components empower legal and procurement teams to proactively identify and address potential risks, ensuring that all third-party relationships are secure, compliant, and financially stable.

MarketIQ Cyber, powered by SecurityScorecard, offers real-time monitoring of third-party cybersecurity practices. The third-party risk management dashboard enables organisations to easily identify vulnerabilities in their third-party ecosystem, including network security, application security, and data protection measures.

This real-time monitoring capability enables teams to detect and address potential cyber threats. By doing so, businesses minimise the risk of cyber incidents that could compromise sensitive information or disrupt critical business operations.

MarketIQ Finance, powered by Creditsafe, provides comprehensive financial analysis of third-party vendors. The dashboard highlights potential financial risks, such as signs of insolvency, late payments, or significant distress.

Easily access credit ratings and financial risk scores so your business only engages with financially sound and dependable vendors. Beyond onboarding, this visibility also helps you to prioritise risk mitigation efforts and make strategic decisions, such as vendor consolidation.

MarketIQ Screen, powered by Creditsafe, offers thorough screening and compliance checks of third-party vendors. This TPRM dashboard provides visibility into which vendors meet regulatory standards and protects businesses from various risks, including politically exposed persons (PEP), sanctions, and other compliance issues.

MarketIQ Screen continuously monitors global sanctions lists, including those from OFAC, UN, EU, and other major regulatory bodies. It alerts your business when a third-party vendor or associated individuals appear on these lists, helping to prevent transactions with sanctioned entities and ensuring compliance with international laws.

MarketIQ Third Party Risk Management Dashboards

MarketIQ Third Party Risk Management Dashboards

Third-party risk management dashboards are critical tools for building a resilient, secure, and compliant business environment.

Dashboards streamline the risk management process by automating assessments and reporting but also improve efficiency and accuracy, allowing your business to prioritise its risk mitigation efforts effectively.

If you’re ready to move away from manual methods and improve your vendor risk management approach, get in touch today.

Ready to improve your contract & vendor management?

.png)

.png)

.png)

-4.png)

Before Gatekeeper, our contracts

Anastasiia Sergeeva, Legal Operations Manager, BlaBlaCar

were everywhere and nowhere.

Gatekeeper is that friendly tap on the shoulder,

Donna Roccoforte, Paralegal, Hakkasan Group

to remind me what needs our attention.

Great System. Vetted over 25 other systems

Randall S. Wood, Associate Corporate Counsel, Cricut

and Gatekeeper rose to the top.

Thank you for requesting your demo.

Next Step - Book a Call

Please book a convenient time for a quick call to discuss your requirements.