Enterprise Data & Analytics (D&A) governance isn't just another IT project. It's now firmly in the CFO's remit.

Gartner highlights that 75% of CFOs have inherited enterprise-wide D&A governance responsibility in 2025.

Yet, despite stepping up to own governance, many CFOs face significant challenges managing contract data manually, making it difficult to achieve full visibility and control over their enterprise data.

Contracts are fundamental to financial clarity, risk management, and business strategy, yet their data remains trapped in PDFs, spreadsheets, or buried in email chains.

This creates a dangerous blind spot, undermining your ability to deliver the trusted, auditable insights that boards and CEOs demand.

Without clear visibility into contract data, your governance strategy falters.

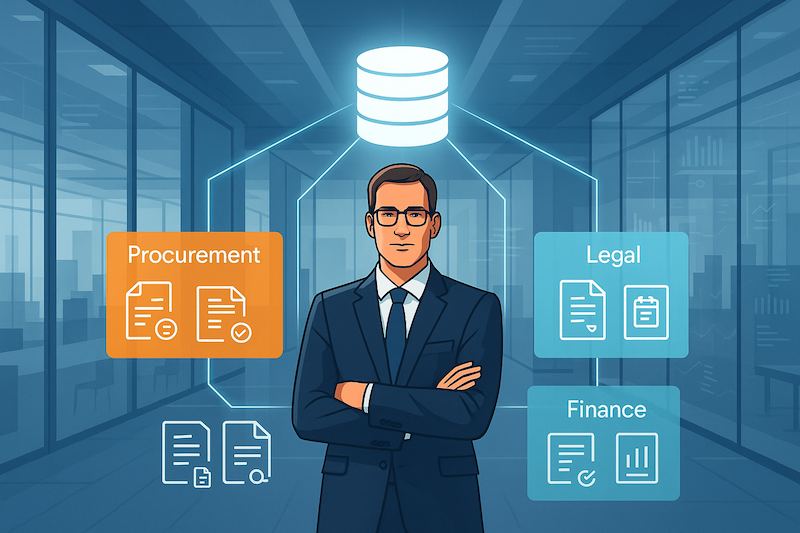

CFOs need integrated and accurate data but contracts dispersed across procurement, legal, and finance silos undermine governance standards, create inconsistency, and lead to costly duplication.

When contracts aren't properly governed, CFOs face specific financial and operational challenges that impact their strategic objectives:

Financial forecasting inaccuracies: Without a unified view of contract data, CFOs struggle to deliver reliable financial projections, impacting revenue forecasts, budget accuracy, and strategic investment decisions.

Risk exposure and compliance gaps: Lack of transparent access controls and detailed audit trails prevents CFOs from confidently demonstrating compliance during audits, increasing vulnerability to regulatory penalties and damage to organisational reputation.

Operational inefficiency and cost leakage: Manually reconciling contract data across procurement, legal, and finance teams consumes valuable resources and introduces costly errors. This inefficiency diverts finance resources from strategic initiatives, directly impacting cost management and profitability.

By overcoming these challenges with effective contract governance, CFOs can enhance financial visibility, minimise compliance risks, and allocate resources more strategically.

Watch our webinar below to find out how you can improve your contract usage and governance.

According to Gartner, effective D&A governance hinges on three pillars: people, technology, and processes.

Integrating contract management into this model directly supports CFOs' strategic goals when collaborating closely with procurement, legal, and risk teams:

People: Clearly defined roles and responsibilities ensure procurement, legal, and finance teams have unified oversight and accountability for accessing, managing, and auditing contract data. This alignment fosters better collaboration, improves communication across teams, and supports CFO-led strategic decision-making.

Technology: Centralised systems provide standardised, secure, and auditable access to contract data, empowering CFOs to rapidly address procurement efficiencies, legal compliance demands, and risk management imperatives. This centralisation enhances visibility, accelerates audits, and ensures timely responses to financial and regulatory requirements.

Processes: Streamlined workflows and consistent data standards embedded into your broader governance framework help CFOs maintain operational efficiency and compliance. By automating manual processes, reducing duplication of effort, and ensuring accurate data across procurement, legal, and risk functions, CFOs can drive more strategic, informed, and proactive governance outcomes.

Vendor & Contract Lifecycle Management (VCLM) enables CFOs to effectively integrate contracts into their enterprise governance framework, transforming scattered and manually managed documents into strategic, controlled, and actionable data assets.

.png?width=1032&height=1067&name=_-%20visual%20selection%20(13).png)

With VCLM software, CFOs gain visibility, improve control, and streamline operations across key functional areas, significantly enhancing their ability to manage financial risk and optimise organisational performance. Here’s the expanded step-by-step approach:

Centralise: Consolidate all contracts into a single, secure, governed contract repository, eliminating inconsistencies, duplication, and document loss. Centralisation ensures all stakeholders across procurement, legal, finance, and risk management access a unified, real-time view, simplifying oversight and collaboration.

Govern: Establish clear, role-based permissions with comprehensive audit trails, providing oversight, accountability, and enforceable governance across procurement, finance, legal, and risk teams. This structured governance framework supports compliance with regulatory standards, reduces operational risk, and enhances financial audit readiness.

Standardise: Automate the extraction and standardisation of essential metadata, such as contract renewal dates, escalation clauses, rebate triggers, vendor performance metrics, and compliance checkpoints. This ensures uniform data quality and reliable insights enterprise-wide. Standardisation through automated workflows reduces manual errors, improves data reliability, and enhances strategic decision-making capabilities.

Integrate: Seamlessly feed this standardised contract data into your existing analytics platforms and ERP systems, like NetSuite, aligning contracts directly with enterprise-wide data governance standards and CFO strategic priorities. Integration eliminates data silos, ensures real-time insights, accelerates financial reporting, and strengthens strategic forecasting and planning activities.

Optimise: Leverage actionable insights gained from integrated contract data to proactively manage vendor performance, financial risks, and contractual opportunities, driving continuous operational improvement and enhanced profitability.

.png?width=720&height=288&name=Screenshot%202023-11-22%20at%2009.23.32%20(1).png)

Before Gatekeeper, NYCM Insurance relied on a manually intensive, internally developed contract management database, which caused significant inefficiencies and limited visibility.

Since adopting Gatekeeper's VCLM solution, NYCM achieved substantial operational improvements:

This strategic transition underscores how Gatekeeper empowers CFOs to deliver robust data governance, improved compliance, and tangible cost savings.

Ready to improve your contract & vendor management?

.png)

.png)

.png)

-4.png)

Before Gatekeeper, our contracts

Anastasiia Sergeeva, Legal Operations Manager, BlaBlaCar

were everywhere and nowhere.

Gatekeeper is that friendly tap on the shoulder,

Donna Roccoforte, Paralegal, Hakkasan Group

to remind me what needs our attention.

Great System. Vetted over 25 other systems

Randall S. Wood, Associate Corporate Counsel, Cricut

and Gatekeeper rose to the top.

Thank you for requesting your demo.

Next Step - Book a Call

Please book a convenient time for a quick call to discuss your requirements.